A synthetic passport is not a real document. It’s a term used to describe a type of identity fraud where a criminal combines real information from multiple victims to create a new, seemingly legitimate identity. This is different from a stolen identity, where a single person’s information is used.

How Synthetic Identity Fraud Works

In synthetic identity fraud, a criminal might take a real Social Security number (SSN) from one person, a birth date from another, and an address from a third. They then use this combination of data to create a new identity that doesn’t belong to any one real person. This fake identity, or “synthetic passport,” can then be used to open bank accounts, apply for credit cards, or take out loans.

The process typically involves several stages:

- Data Acquisition: Fraudsters gather real personal information, often from data breaches, phishing scams, or the dark web. They may target individuals with little to no credit history, such as children, the elderly, or those who are new to the country.

- Identity Creation: The criminal blends real data (like a valid SSN) with fabricated details (like a fake name or address) to create a new, fictitious identity. This new identity is often designed to appear legitimate.

- Credit Profile Building: This is a crucial and often lengthy step. The fraudster uses the synthetic identity to apply for credit, knowing they will likely be denied at first. However, the application creates a credit file for the new identity. They will then “nurture” the identity by making small purchases and paying them off on time to build a positive credit history and increase their credit limit. This process can take months or even years.

- The “Bust-Out”: Once the synthetic identity has a strong credit history and high credit limits, the fraudster “busts out” by maxing out all available credit lines and disappearing without a trace.

Key characteristics of synthetic identity fraud:

- Blending of real and fake data: The fraudster combines legitimate pieces of information from different individuals.

- New identity creation: A new, fictional identity is established, often with a fabricated name.

- Building a credit profile: The fraudster will often use the new identity to slowly build up a credit history, making it appear more legitimate over time. This process is called “credit washing” or “credit piggybacking.”

- Difficulty in detection: Because the identity doesn’t belong to a single victim, it’s very hard for financial institutions and credit bureaus to flag the activity as fraudulent.

Real vs. Synthetic Identity Fraud

Here’s a comparison of traditional identity fraud and synthetic identity fraud:

| Feature | Traditional Identity Fraud | Synthetic Identity Fraud |

| Data Source | A single victim’s information (e.g., SSN, name, address) | A mix of real data from multiple victims and fake data |

| Identity | Impersonates a real person | Creates a new, fictional identity |

| Detection | Often discovered when a victim notices unauthorized activity on their accounts | Hard to detect; often only found after the fraudster “busts out” |

| Victims | A single individual whose identity is stolen | Multiple individuals whose data is used; financial institutions are the primary victims of the loss |

Why is it a Growing Problem?

Synthetic identity fraud is one of the fastest-growing types of financial crime. Recent data suggests that losses from this type of fraud have reached billions of dollars. Some reports estimate that losses in the U.S. alone are in the range of “$20 to 40 billion and growing.” This is due to several factors:

- Availability of data: The vast amount of personal information available online and through data breaches makes it easier for criminals to obtain the raw materials needed to create a synthetic identity.

- Evolving technology: The use of generative AI has made it significantly easier and faster for criminals to create convincing synthetic identities and fake documents at a massive scale.

- Challenges in validation: Current systems for identity verification, which often rely on matching a name to a SSN, are vulnerable to this type of fraud because the synthetic identity may eventually have a seemingly legitimate credit history.

How to Protect Yourself

While financial institutions are the primary victims of the financial losses, individuals whose data is used can still be affected. Their credit scores may be negatively impacted if their information is linked to the fraudulent activity, and they may receive bills for accounts they never opened.

Here are some steps to help protect yourself:

- Monitor your credit reports regularly: Look for any accounts or inquiries you don’t recognize. You can get free copies of your credit report from each of the three major credit bureaus annually.

- Be cautious with your personal information: Avoid sharing your Social Security number or other sensitive data unless absolutely necessary.

- Use strong passwords and multi-factor authentication: This can prevent your accounts from being compromised in a data breach.

- Be wary of phishing attempts: Never click on suspicious links or provide personal information in response to unsolicited emails or texts.

- Monitor your Social Security statements: Check your Social Security statement for any discrepancies in your reported earnings, as this could indicate someone is using your SSN for employment.

- Consider freezing your credit: This is a powerful tool that prevents new creditors from accessing your credit report, making it difficult for fraudsters to open new accounts in your name. You can unfreeze it temporarily when you need to apply for credit yourself.

FAQs

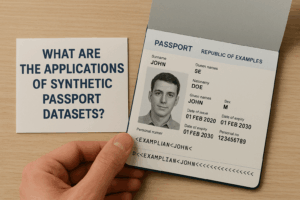

Fraudsters may create realistic-looking synthetic passports to bypass weak identity verification systems.

Because advanced AI can generate near-real documents that mimic genuine passports.

They use biometric verification, liveness detection, and forensic document analysis.

Banking, fintech, travel, and government services are prime targets.

Yes, strong biometric PAD (Presentation Attack Detection) testing reduces risks from synthetic identity attacks.